Inflation appears to be book-ending my career. I started my work as an economist in the Research Division of the Federal Reserve Board in Washington, D.C., in the late 1970s. Inflation had been trending higher for years. Neither Arthur Burns nor G. William Miller, the Fed chairmen preceding Volcker, had the fortitude to raise interest rates sufficiently and keep them there long enough to reduce inflation to a low sustainable pace. Paul Volcker pulled it off–for which he was personally vilified at the time. But since then, Paul Volcker has become a legend, esteemed as the central banker whose brute-force campaign subdued inflation for decades.

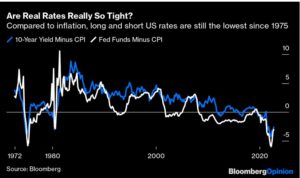

You can see in the chart below that in late 1979, the Volcker Fed hiked the overnight policy rate to levels well above the inflation rate and kept real interest rates (nominal rate minus inflation rate) positive for an extended period.

The current Fed Chair, Jay Powell, has expressed deep admiration for Paul Volcker, calling him “the greatest economic public servant of the era.” Last month, Powell alluded to his predecessor’s record of persistence, saying that policymakers “will keep at it until the job is done” — invoking Volcker’s memoir, “Keeping at It.”

The Bank of Canada was no slouch on the inflation front as well. As the chart shows, the Bank hiked interest rates in lockstep with the Fed in the Volcker years and even more in the early 1990s when Ottawa was fighting Canadian budgetary red ink to the ground.

This time around, Tiff Macklem has been ahead of the Fed in hiking interest rates and, in a speech on Thursday, said that the economy is still “clearly” in excess demand, with businesses facing an extremely tight labour market, wage gains broadening and underlying inflation pressures showing no signs of letting up. Macklem said that the sources of inflation, which started with goods prices, are broadening to the service sector. “. Labour markets remain very tight. Job vacancies have eased a little in recent months but remain exceptionally high. Our business surveys report widespread labour shortages. And wage growth has risen and continues to broaden.”

“With demand running ahead of supply, competition is posing less of a restraint on price increases, and businesses are passing through higher input costs more quickly. As a result, higher energy and material costs are showing up in the prices of a growing list of goods and services. So even if there is some relief at the gas pumps, price pressures remain high and continue to broaden. In August, the prices of more than three-quarters of the goods and services that make up the CPI were rising faster than 3%.”

Macklem continued, “As we look for a more fundamental turning point in inflation, measures of core inflation are becoming increasingly relevant…after taking out volatile components in the CPI that don’t reflect generalized changes in prices, inflation is running about 5%. That’s too high. We can also see that our core measures have yet to decline meaningfully even though total CPI inflation has come down in the last couple of months. Going forward, we will be watching our measures of core inflation closely for clear evidence of a turning point in underlying inflation.” In conclusion, the governor said, “there is more to be done….We know we are still a long way from the 2% target. We know it will take some time to get there. We also know there could be setbacks along the way, and we can’t afford to let high inflation become entrenched.”

So given the clear statements by the Fed and the Bank of Canada, it makes no sense why Bay Street economists are betting that the overnight rate in Canada will peak at around 4% by yearend. They are still forecasting a decline in short-term interest rates next year due to a slowdown in economic activity. I don’t buy that.There are many views on how far the central banks will have to hike rates from here, but the critical issue is to reach a point where rates are meaningfully restrictive. A rule of thumb is that the overnight policy rate must rise to exceed the inflation rate. Fed Chairman Powell has said that he believes that real interest rates should be positive across the yield curve. Today, long and short US rates are still the lowest compared to inflation since the Burns era in the mid-1970s. (see chart below). Traders are betting that the US overnight rate will rise another 125 basis points (bps) by yearend and continue to rise next year to a median estimate of 4.6%.

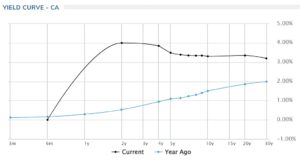

Chair Powell has clarified that he is willing to tolerate much slower growth. As Bloomberg economists suggest, “Canada is seen having both faster growth and lower interest rates over the next three years — a peculiar mix of economic outcomes that assumes the country is more buffered from global headwinds — including a potential US recession — but won’t face the same pressure to match the Fed higher.”Short-term money markets are betting the Bank of Canada will stop its hiking cycle at about 4%, versus a Fed benchmark rate peaking at about 4.6% and remaining below US short-term rates for at least another three years.This is especially unreasonable given the fall in the Canadian dollar, which is now trading at US$0.728 compared to US$0.814 one year ago. This depreciation reflects the inordinate strength of the US dollar–the global safe-haven currency in a time of enormous uncertainty and volatility. The Canadian dollar has fared far better than other G-7 countries over this period. But the decline in our currency will raise the prices of the many US products and services we import, adding to inflation.Inverted Yield CurvesIn Canada and the US, 2-year yields have risen sharply to levels well above 5-year yields. As of October 6, the 2-year Government of Canada bond yield is at 4.0% compared to the 5-year yield at 3.49% and the 10-year yield at 3.31%. This implies the markets expect a slowdown in economic activity, but that does not mean that the overnight policy rate will fall in 2023 as Bay Street expects, especially if core inflation remains well above 2%. The Canadian prime rate is currently 5.45%, well above the 5-year yield of 3.49%. When the Bank of Canada Governing Council meets again on October 26, it will likely raise the policy rate by at least 50 bps to 3.75%, taking the prime rate up to 5.95% or higher—clearly improving the relative attractiveness of fixed-rate mortgage loans.

Bottom Line

For most of my readers, inflation is a brand-new experience, and so are rising interest rates. Inflation in Canada was at 2.2% when the pandemic began, and the 5-year bond yield was a mere 1.3%. Quickly the central bank cut the overnight rate from 1.75% to 0.25%, the prime rate fell from 3.95% to 2.45%, and the 5-year bond yield fell to a low of about 0.32%. Housing demand exploded and continued strong until it peaked in February 2022 when the Bank of Canada began to hike interest rates.Interest rates will not fall to pre-pandemic levels next year or even the year after. And we will likely never see interest rates at pandemic levels again, at least I hope not, because it would take another global economic shutdown. Hence, mortgage-borrower psychology will change. Many more homeowners will choose to lock in fixed interest rates, and by the time this is over, a new generation will realize that interest rates don’t just fall but sometimes rise to levels higher than expected and stay there longer than expected—a painful lesson to learn.

Dr. Sherry Cooper

Chief Economist, Dominion Lending Centres

drsherrycooper@dominionlending.ca |