Fixed mortgage rates are expected to take another step up next week, pushing some 5-year fixed mortgages into 6% territory.

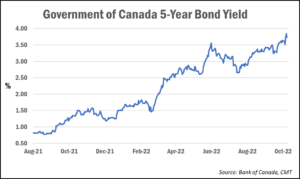

Five-year fixed mortgage rates typically follow the Government of Canada 5-year bond yield, which surged more than 40 basis points over the course of the week—briefly reaching a 14-year high on Friday—before retracing some of the gains.

Why are bond yields rising?

According to Ryan Sims, a mortgage broker with TMG The Mortgage Group and a former investment banker, markets are reacting to the recent inflation data that came out of Canada and the U.S.

“Both readings were above a level that central banks are comfortable with,” Sims told CMT. That has raised expectations for future interest rate hikes, at least in Canada.

Canada’s Consumer Price Index ticked down to 6.9% in September, which was higher than expected, while core inflation continued to climb. Meanwhile, inflation continued to accelerate south of the border, with overall prices rising 8.2% in September and core inflation, which strips out more volatile items, up 6.6%—the fastest pace in four decades.

However, the sharp pullback in bond yields from their initial highs on Friday came following speculation the U.S. Federal Reserve is set to slow the pace of rate hikes following its November meeting.

“Usually when we see an intra-day move like we have today (without news, central bank speeches, or an “event”), it would signal to me that the top, at least for now, is in,” Sims said.

“This kind of intra-day volatility on any asset class is something that is usually marked by a lower high, and a lower low,” he added. “I’m not saying we see an immediate drop, but a slow march towards lower yields.”

What does it mean for mortgage rates?

Despite the midday pullback in yields, fixed mortgage rates are still expected to march higher by next week.

“Rates will increase next week just based on the large move-up in the last few days,” Sims said. “Uninsured [fixed rates] will start with a 6-handle, and even insured rates could be in the high 5’s without much work. You may get a lender who is trying to buy business that keeps rates in the mid 5’s.”

A number of lenders have already been raising some of their fixed-rated products since last week, including most of the Big 6 banks.

According to data from MortgageLogic.news, the average nationally available deep-discount rate for a 5-year fixed mortgage is now 5.57% (+15 bps since early last week), while insured rates are averaging 5.28% (+15 bps).

“Everyone should also remember that what comes up, can just as easily come down,” Sims added. “Short-term bond yields have started to roll over state-side, and that is signalling that the bond market thinks that maybe the central banks have gone too far and too fast.”